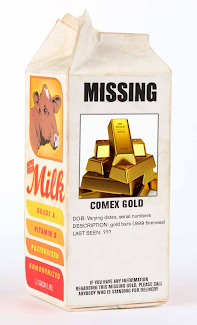

"U.S. Mint now suspends all one ounce gold coin sales due to shortage of physical gold"

Here's the article link: U.S. Supends Gold Eagle/Buffalo Production

As a matter of fact the Gold Bullion Act of 1985 authorizes the U.S. Mint to use U.S. Government gold reserves if necessary:

In the absence of available supplies of such gold at the average world price, the Secretary may use gold from reserves held by the United States to mint the coins issued under section 5112(i) of this title. The Secretary shall issue such regulations as may be necessary to carry out this paragraph”.It would seem that if the United States has 8100 tons of gold, as reported by the Federal Reserve and U.S. Treasury, then there should NEVER be a shortage of gold with which to mint coins. What gives?

Here is the complete text of Gold Bullion Act of 1985: Where's Our Gold Coins?

Again, inquring minds want to know, where is all the gold? How come the U.S. Mint didn't foresee the same shortage everyone else in the market has been seeing and make sure that it had plenty of production blanks to meet demand? If the Comex supposedly has 9 million ounces of 100 oz. bullion bars, the Mint should have been able to take delivery of some of that gold in order to meet its legal obligation to produce gold coins in an amount that meets demand. How come the U.S. Mint is not using U.S. Government gold reserves, as per the law?

Something smells fishy here, and I think we all know what it is: the physical supply of gold is extremely tight, the paper shorts in gold (Comex, GLD, LME, etc) are in big trouble and the price of gold is now at the mercy of the physical market. I would suggest this situation is one of the primary reasons that the Federal Reserve and its supporters in Congress are going to any lengths to derail efforts to force an independent audit of the Fed, which would include a physical audit of the gold it supposedly holds.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_6.gif)

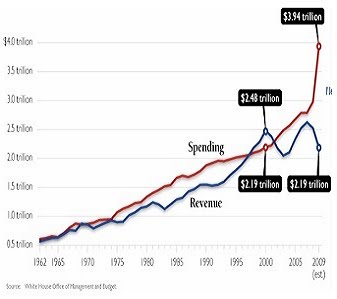

Instead of printing fiat money to pay for ACORN pet projects, why not grab all the gold and PM's that money can buy and throw it in the Federal kitty? For the cost of ink and paper, the Obama administration could double our supply, link the dollar to gold (gold standard) and win over many Hope/Change disbelievers.

ReplyDeleteLOL. They aren't interested in saving the U.S. They are only interested in doing what they need to do to enrich themselves

ReplyDeleteThis would be a stronger argument for a shortage of physical gold if the Mint took bars and turned them into coins. Instead, they order blanks, and stamp the coinage onto them. The blanks are disc shaped. They have continued to miss forecast their needs.

ReplyDeleteBut I should add this does nothing to diminish the argument that there are shortages of physical gold either. It is just that this might not be as straightforward an indication as one might suspect at first blush.

ReplyDeleteI am sure their subcontractors have lead times and thin margins on fabricating raw gold into coin ready blanks.

Does Jesse = Edmund C. Moy?

ReplyDeleteIndeed, as Jessie suggests, is there, in fact, a shortage? Perhaps there is a shortage, but only in available supply. What am I getting at? I recall years-really decades- ago, hearing trader Ed Seykota offer that there would one day be an international gold hoard. I don't know if he was serious or not, but I would say that, as per the work of someone like Antal Fekete, that we may well be in the process of seeing those who own gold bullion and coins in size not selling at any but prices but those that are vastly higher than present. Permanent backwardation, or the last contango in D.C. as Professor Fekete puts it may indeed by at hand. Of course, at the margin, there wil always some selling of physical, but it is likely inconsequential as regards the secular trend.

ReplyDeleteJesse:

ReplyDeleteWhere do the blanks for U.S. Mint coins come from? They must come from the same type of refining process that makes the Comex and LBMA bars. The LAW states that the U.S. Mint is to use U.S. Govt gold reserves if it needs to do. I'm sure the process to extrude "discs" from LBMA/Comex bars is fairly straightforward.

The bottom line is that the U.S. Mint has a way to prevent from suspending production, an act which is in direct violation of the Law, and it is not engaging in that remedy.

Why?

Jesse: here's the language from the 1985 gold bullion act. IF THE MINT DOES NOT HAVE "DISCS" it is use US GOVT RESERVE GOLD:

ReplyDelete"In the absence of available supplies of such gold at the average world price, the Secretary may use gold from reserves held by the United States to mint the coins issued under section 5112(i) of this title. The Secretary shall issue such regulations as may be necessary to carry out this paragraph”."

The link to the Act is in my blog. My arugment is very strong unless you have a good reason why the Mint is not complying with the law.

The new Audit the Federal Reserve Bill needs to include an Audit the US Gold Reserves section in my opinion and the Audit should include scanning for the quality and authenticity of the gold bars and not just a count of bars and pallets because frankly, I don't trust that the bars are even entirely real.

ReplyDeleteDuffmisnter

http://www.duffminster.com/SilverandGold

According to th Gold Bullion Act of 1985 they may only use gold from the government stockpile if they cannot get it from freshly mined American gold. Maybe the bottleneck is somewhere along the path from the miners to the blank makers.

ReplyDelete“(3) The Secretary shall acquire gold for the coins issued under section 5112(i) of this title by purchase of gold mined from natural deposits in the United States, or in a territory or possession of the United States, within one year after the month in which the ore from which it is derived was mined. The Secretary shall pay not more than the average world price for the gold. In the absence of available supplies of such gold at the average world price, the Secretary may use gold from reserves held by the United States to mint the coins issued under section 5112(i) of this title. The Secretary shall issue such regulations as may be necessary to carry out this paragraph”.

"In the absence of available supplies of such gold at the average world price, the Secretary 'MAY' use gold from reserves held by the United States to mint the coins issued under section 5112(i) of this title. The Secretary shall issue such regulations as may be necessary to carry out this paragraph”."

ReplyDelete"May" does not mean "must."

The Secretary shall mint and issue the gold coins ... in quantities sufficient to meet public demand.

ReplyDelete"Shall" means "must".

In Europe you can buy bullion gold by your brooker in 14 days delay. Silver even takes just 1 day. So buy in the market if no supply.

ReplyDeleteFlanders

The mint sells silver and gold coins with a profit dont they?

ReplyDeleteThe bullion price is at least 10% over spot minted and there is added value by the sort of coin: buffalo, eagle go on.

When proffitable wat's the problem to deliver?

http://thomas.loc.gov/cgi-bin/query/D?c107:4:./temp/~c107L9nt2h::

ReplyDeleteSimilar situation for silver; but in 2002, Reid and Crapo modified Public Law so Treasury could obtain outside U.S.

You have posted a great collection and nice information about silver and gold coins. I also visited a site in that various collections of

ReplyDeleteGold Coins Ounceand silver coins are available .You can also visit that site to know more about coins.

In Thailand, there is a gold shop on almost every corner in every town and city. It's 96.5% pure (23k) and sold at market price plus THB 200 (~$7) commission for 5 baht (2.144 oz) bars. You take delivery on the spot if they are in stock or leave a dposit and return within a week if they are out of stock. Jewelry of the same quality is ALWAYS available at market + THB 400 + commission of @THB 300.

ReplyDeleteTake a vacation and buy some gold while you are at it. It is either not taxable or taxable at 4.5% when you bring it into the US - depends on the Customs Officer and their supervisor's interpretation of the Customs guidelines.

US Mint "Stonewalling"

ReplyDeleteGood read from Mineweb posted earlier this year on 9/14/09 (http://www.mineweb.com/mineweb/view/mineweb/en/page34?oid=86213&sn=Detail) on attempts to provide product to the US mint. A recent article also suggests NW territorial mint has been refused as a supplier in the past.

"While gold and silver producers have repeatedly gone to government officials to get them to authorize an increase in the number of refineries which can produce the blanks and the facilities that can mint the coins, industry sources say they feel they have been stonewalled by mint officials who refuse to budge.

Among the U.S. manufacturers of blanks is Sunshine Minting in Coeur d'Alene, Idaho, and Stern-Leach of Attleboro, Massachusetts. Nearly all U.S. Mint gold coins at manufactured at West Point, New York at a remote site on military academy grounds.

U.S. Mint spokesman Michael White told Mineweb refiners are running 24-hours a day, seven days a week trying to meet demand for blanks."

dave,

ReplyDeleteI fully agree with you that the US Mint should go to the US Gold reserve. The problem is there ain't no Gold there.

When this revelation comes to light it will denote the end of the USD. I do not believe the USD will make it out of 2010.

Most people cannot fathom this possibility as it would mean the demise of US Empire and our descent into the 3rd world.

It's gonna happen because there is a much larger unfolding wave of reality coming.

Joe M.

Congressional Act Section 5112 coins must contain fine gold.

ReplyDeleteThe problem is the US Gold reserve is tungsten!

@Anonymous/Joe: LOL - we can laugh at that comment, but until proven otherwise, it is likely true to a large extent.

ReplyDeletePhysical gold is available but blanks to make coins are in high demand and not available in quantities to meet it. See this article: www.forbes.com/2009/11/25/gold-coins-shortage-markets-commodities-mint.html?partner=msn

ReplyDelete400 oz. gold bars filled with tungsten turned up in Hong Kong recently. I wonder where they came from?

ReplyDeleteThe Gold is Gone. Where? Ask Bill Clinton....

ReplyDeleteThe tungsten gold story is an urban legend. The only people who trade in god bars must be thoroughly accredited. They only buy from other accredited agencies and never sell to individuals. An idividual could purchase a gold bar, but not from an accredited source. Likewise, no accredited agency would ever purchase a gold bar from an individual. Those stories going around about gold plated tungsten are crap.

ReplyDeleteI'm not so sure the tungsten rumor is crap. That may be why the Mint cannot fill orders - it knows that its' so-called Ft. Knox storage facility has been looted and replaced with tungsten-filled bars. Who looted it? Bush, Clinton, Bush, Obama, you name it.

ReplyDeleteIf I were a government and gold prices were rising....and I expected them to rise higher.....I would suspend sales too. Why sell coins today if YOU actually have the power to increase the price of them tomorrow?!?!?!

ReplyDelete