The Mortgage Bankers Association posted its weekly mortgage applications index today. Applications to purchase homes are absolutely plummeting in free-fall fashion. The non-adjusted/non-manipulated number was down 18.2% from last year. Here's the LINK

Deflationism should be dead by now. I just got off the phone with a good friend/colleague who operates a food retailing business. He told me standard non-organic hothouse tomatoes have gone up in price to $51 per case from $25 last week and $42 per case this last Monday. He said he's selling bulk food containers like there's no tomorrow. Here's a nice little quickie on inflation: LINK

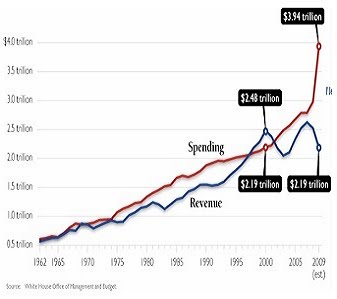

Finally, I don't normally like to litter my blog with garbage from clusterstock.com, but this is a great guest post that was on there today that nicely summarizes the catastrophic problems which are taking this country down. You just need to look at the graphs, most of which are from the Fed: LINK

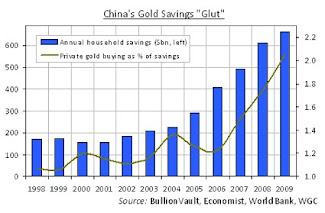

Make no mistake about it, assuming it is available, your ability to buy food will be protected ONLY if you have plenty of gold and silver - physical gold/silver, not CEF, GLD, SLV, GTU, or even PHYS, unless yo have enough money to buy enough share PHYS shares to convert into gold (about $550k today).

Buona giornata/serata a tutti!

Wednesday, February 16, 2011

Subscribe to:

Post Comments (Atom)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_6.gif)

http://theeconomiccollapseblog.com/archives/what-is-wrong-with-the-u-s-economy-here-are-10-economic-charts-that-will-blow-your-mind

ReplyDeleteIn case you decide to skip the middleman.

Some of this blogs 'rebrand' as much as Walmart

Dave,

ReplyDeleteThe last post was a nice pick up on the potential inverse H+S pattern. Are you speaking Italian now??

Thanks! Hey I'm moving into a penthouse apt. in early March that has killer view and a 400 sq. ft. patio. Going to wave in one of those of green egg grills! (the unit also comes with a private hot tub). Started learning Italian in October. Ya have to find things to stay busy at night when you don't have kids lol. Capisci/Parli l'italiano?

ReplyDeleteLOL Jesse. I used to go to that economiccollapse blog all the time but I grew weary of it.

ReplyDeleteI think this summary from

ReplyDeletehttp://globaleconomicanalysis.blogspot.com/2011/02/next-borrow-short-lend-long-guaranteed.html

pretty much sums up the US banking industry:

Want to know what those banks thinking? This is what ....

* They are too big too fail

* The Fed will bail them out

* Cities won't default but who cares anyway because the Fed will bail them out

* They have a hot pile of cash the Fed crammed down their throats at 0% and they want to put it to use

* They got burnt badly on mortgages and home equity loans so they need to find something new

* One idiot bank made an absurdly risky deal so like sheep they all want to do it

Right now they are all thinking there is nothing to lose from this. The Fed or Congress will bail them out at taxpayer expense if they get in trouble.

Then, when this does get out of control and blows sky high, they will all scream, "no one could possibly have seen it coming".

The status quo cannot wrap their head around the possibility of a USD collapse, but it's coming.

ReplyDeleteJoe M.

Joe, just like in Weimar Germany - same thing. "History repeats: first time as tragedy, second time as a farce"

ReplyDeleteIt's funny because we chat with potential investors sitting on millions in the bank. They for the life of them can't grasp that once the rest of the world won't accept paper dollars, their wealth will be wiped out.

And it's even harder for them to grasp the notion that their wealth will be entirely preserved if they own physical gold/silver and possibly even increased if they have exposure to mining stocks!

ReplyDeleteDave,

ReplyDeleteThis just goes to show that even though these people are savvy enough to become millionaires they do not understand the true nature of the system we reside in, which is fiat and has a 100% mortality rate.

I mostly blame the monied elite and their captive propaganda media for our current situation.

Joe M.

HI Dave, I know you are a believer in owning physical PMs and not the ETFs. Unfortunately that is all I own currently but I want to get into physical now. Since I have never done this before if I purchase gold coins how do I resell them in the future ? Does the place I sell them to need to verify there authenticity and is there a charge for that which they deduct from the sale price ? I can imagine that once the price of gold rockets there will be a lot of scammers trying to cash in with "fake" gold. Thanks.

ReplyDeleteAgree Joe.

ReplyDeletemabman: If you going to spend enough money to buy at least 20 1oz. gold coins or 500 ozs. of silver, make sure you use www.tulving.com he has the best prices and service by far. Make sure you buy only the sovereign-minted coins (gold/silver eagles, maple leafs, philharmonics). That way you'll never have an authenticity issue.

In terms of "reselling." There are many ways to to do this. I have used craigslist locally here in Denver every time I've sold and this is the reason you buy sovereign-minted only coins. People who buy them know what they look like. I've done this many times and only once did someone come to our meeting with a bullion scale and calibrated measuring device to measure weight, width and diameter of the my austrian philharmonics. They were perfect! lol.

Also, as more people here lose confidence in the dollar, we'll eventually be exchanging bullion for goods. THere's already a local grocer in SoCal who is doing this. It will become widespread.

You won't pay taxes on gains this way either.

People should worry more about getting bullion acquired right now rather than how to unload it. The latter will take care of it.